December 2024

We collect cookies to enhance your browsing experience Learn more

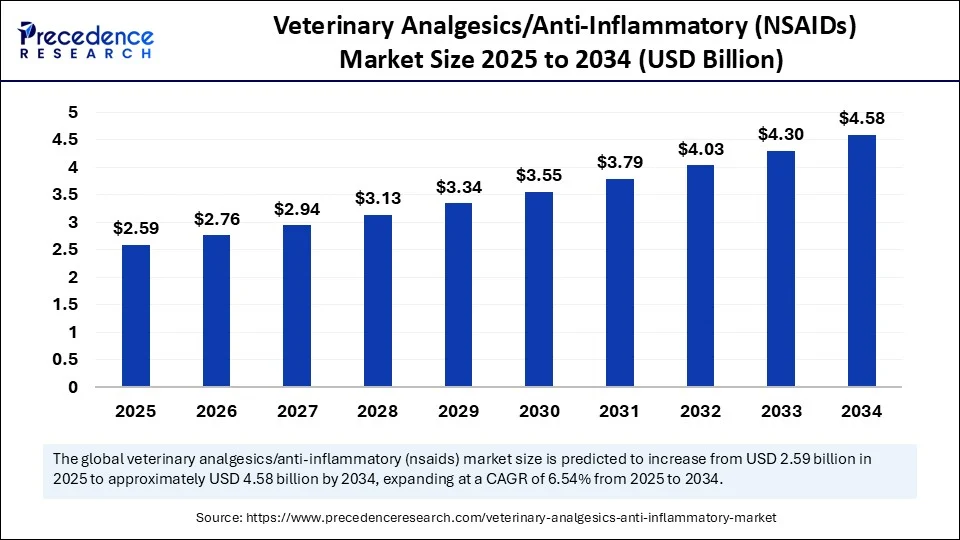

The global veterinary analgesics/anti-inflammatory (NSAIDs) market size is calculated at USD 2.59 billion in 2025 and is forecasted to reach around USD 4.58 billion by 2034, accelerating at a CAGR of 6.54% from 2025 to 2034. The North America market size surpassed USD 886.95 million in 2024 and is expanding at a CAGR of 6.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global veterinary analgesics/anti-inflammatory (NSAIDs) market size accounted for USD 2.43 billion in 2024 and is predicted to increase from USD 2.59 billion in 2025 to approximately USD 4.58 billion by 2034, expanding at a CAGR of 6.54% from 2025 to 2034. The market is experiencing substantial growth, driven by an increasing pet population and a rising awareness of animal health. Additionally, the growing incidence of osteoarthritis and post-surgical pain and advancements in drug formulations are expected to support market expansion in the coming years.

Artificial intelligence (AI) is transforming this market by enhancing diagnostics, treatment planning, and drug discovery. AI algorithms can analyze medical images, predict responses to NSAIDs, and accelerate the development of new analgesic drugs. AI can evaluate data such as age, breed, medical history, etc., to determine which NSAIDs are most likely to be effective and safe for a particular animal, enabling more personalized treatments. AI also speeds up the process of discovering new NSAIDs or refining existing ones by analyzing large molecular datasets to predict drug efficacy and safety. Moreover, AI can identify animals at risk of progressing from acute to chronic pain, allowing for proactive NSAID intervention to prevent long-term pain, while optimizing effectiveness and minimizing side effects.

The U.S. veterinary analgesics/anti-inflammatory (NSAIDs) market size was exhibited at USD 620.87 million in 2024 and is projected to be worth around USD 1,194.69 million by 2034, growing at a CAGR of 6.76% from 2025 to 2034.

What Made North America the Dominant Region in the Veterinary Analgesics/Anti-Inflammatory (NSAIDs) Market in 2024?

North America registered dominance in the veterinary analgesics/anti-inflammatory (NSAIDs) market by capturing the largest revenue share in 2024. This is primarily due to its advanced veterinary infrastructure and high spending on pet healthcare. The presence of leading pharmaceutical companies, such as Zoetis, Elanco, and Merck, ensures the availability of NSAIDs (non-steroidal anti-inflammatory drugs), thereby contributing to market growth. Ongoing research and development activities in veterinary medicine further bolstered regional market growth. Regulatory support and increased awareness of animal health led to a higher adoption rate of pain management solutions like NSAIDs. There are also government initiatives and collaborations aimed at improving animal health and pain management.

U.S. Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market Trends

The U.S. is a major contributor to the North American veterinary analgesics/anti-inflammatory (NSAIDs) market. This is mainly due to the rising pet ownership, increased awareness of animal health, and advancements in veterinary medicine. The U.S. FDA regulates these drugs, ensuring safety and efficacy, while companies like Zoetis and Merck Animal Health drive research and development. Despite regulatory challenges and side effect concerns, there is a high demand for NSAIDs for pain management. The rising development of novel formulations also supports market growth.

In September 2024, the U.S. FDA’s Center for Veterinary Medicine announced the establishment of four Animal and Veterinary Innovation Centers, which are intended to advance regulatory science and innovative products for animal health. These centers focus on three key areas: highly pathogenic avian influenza and zoonotic diseases; intentional genomic alterations in animals for agricultural and public health; and addressing unmet veterinary needs affecting both animal and public health.

(Source: https://www.fda.gov)

What Makes Asia Pacific the Fastest-Growing Market for Veterinary Analgesics/Anti-Inflammatory (NSAIDS)?

Asia Pacific is expected to experience the fastest growth during the forecast period. This growth is largely driven by increasing livestock production, expanding veterinary services, and rising disposable incomes, particularly in countries like China and India. The growing demand for meat and other animal products in the region is leading to increased livestock production, which subsequently drives the need for veterinary care and pain management solutions, such as NSAIDs. Furthermore, enhanced access to and availability of veterinary services, including specialized clinics and diagnostic facilities, are facilitating the diagnosis and treatment of animal pain and inflammation, contributing to market growth. Government initiatives supporting animal welfare and disease control, coupled with advancements in digital technologies for animal health, are also contributing to regional market growth.

Why is Europe Considered a Significant Region in the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market?

Europe is considered to be a significantly growing area. The market in the region is expected to grow due to a strong emphasis on animal welfare, increasing pet ownership, and stringent regulatory oversight. These factors are raising the demand for pain management solutions for both companion and livestock animals. The European Union (EU) has a robust regulatory framework focused on animal welfare, which includes provisions for pain management and the treatment of conditions that cause pain and inflammation. Strict regulations surrounding veterinary pharmaceuticals ensure the safety of both animals and the food chain, leading to a preference for approved and regulated products. This, in turn, boosts the market for veterinary NSAIDs.

What Opportunities Exist in Latin America?

There is strong potential for market expansion in Latin America due to the increasing pet ownership, rising healthcare expenditure for animals, and a greater focus on animal welfare. Advancements in veterinary medicine, including new formulations and drug delivery methods, as well as heightened awareness of the importance of pain relief in animals, are likely to support market growth. Several countries in the region are implementing policies and initiatives aimed at improving animal welfare, which include promoting responsible pet ownership and enhancing access to veterinary care. Organizations such as the Pan American Health Organization (PAHO) are fostering regional cooperation to enhance local manufacturing capacity for essential medicines, including those used in veterinary care.

What are the Major Factors Boosting the Growth of the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in the Middle East & Africa in 2024?

The market in Middle East & Africa is expected to grow at a notable rate in the upcoming period, driven by increasing pet ownership and rising awareness of animal health. There is significant growth in livestock production and farming. Governments in the region are actively promoting animal health through various initiatives, including disease control programs, vaccination campaigns, and investments in veterinary infrastructure, which ultimately support the market. This regional market growth is further attributed to advancements in veterinary care and increased spending on animal healthcare.

The veterinary analgesics/anti-inflammatory (NSAIDs) market includes pharmaceutical products used to manage pain, inflammation, and fever in animals. These medications are commonly prescribed after surgery, during injuries, or for chronic conditions like osteoarthritis. Non-steroidal anti-inflammatory drugs (NSAIDs) are the most widely used class, although opioid and adjunctive analgesics are also employed in veterinary medicine. These drugs, including opioids and non-opioids, provide pain relief for various conditions, from acute injuries to chronic pain. They enhance the effectiveness of other analgesics or help manage pain-related symptoms. Products differ based on species, route of administration, and duration of action. The market is growing significantly due to factors such as increased pet ownership, greater awareness of animal pain management, and advancements in veterinary medicine.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.58 Billion |

| Market Size in 2025 | USD 2.59 Billion |

| Market Size in 2024 | USD 2.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Animal Type, Route of Administration, Indication, Distribution Channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Pet Ownership and Growing Awareness of Pet Health

A major factor driving the growth of the veterinary analgesics/anti-inflammatory (NSAIDs) market is the increasing pet ownership and growing awareness of pet health, leading to higher demand for pain management solutions. Pet owners are more aware of their animals' health needs and are more likely to seek treatment for pain and inflammation, particularly for chronic conditions such as arthritis. This increased awareness creates a high demand for NSAIDs, as pet owners look for effective pain relief options for their pets. Companies are responding by developing more effective and user-friendly NSAID formulations, such as chewable tablets, to improve palatability and ease of administration for both pets and their owners.

Risk of Adverse Effects

The main restraint in this market is the risk of adverse effects. While NSAIDs provide significant pain relief and anti-inflammatory benefits, they can also cause side effects, especially affecting the gastrointestinal, renal, cardiovascular, hepatic, and hematologic systems. Because of these risks, veterinarians need to educate clients about signs of NSAID toxicity, like gastrointestinal upset, changes in appetite, and lethargy. Regular monitoring of animals on long-term NSAID therapy is essential to detect and manage potential adverse effects early.

Development of Targeted Therapies Tailored to Specific Pet Types and Conditions

A key future opportunity in the veterinary analgesics/anti-inflammatory (NSAIDs) market lies in the development of targeted therapies tailored to specific pet types and conditions, especially for long-term management of osteoarthritis in dogs and cats. There is a growing demand for safer, more effective NSAID formulations with fewer side effects for chronic conditions. There is a strong focus on developing NSAIDs for cats and small animals, as well as different age groups and breeds, reflecting a deeper understanding of how NSAIDs impact various species and individuals. Additionally, pet owners are increasingly concerned about potential side effects, such as gastrointestinal issues and kidney problems, creating a need for novel NSAID formulations with improved safety profiles.

How Did the NSAID Segment Dominate the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in 2024?

The NSAID segment dominated the market, with carprofen and meloxicam sub-segments holding a significant share in 2024. This is mainly due to their proven effectiveness and relatively safe side effect profiles, particularly in managing pain and inflammation associated with conditions such as osteoarthritis and post-surgical pain. These drugs work by inhibiting cyclooxygenase (COX) enzymes, which are crucial in producing prostaglandins that mediate pain and inflammation. This makes them valuable for a broad range of veterinary conditions. While all NSAIDs can cause side effects, carprofen and meloxicam are generally considered to have a safer profile compared to other NSAIDs or corticosteroids, especially regarding gastrointestinal problems.

The adjunctive analgesic segment is expected to experience the fastest growth, with the gabapentin sub-segment likely leading the charge. This is mainly because of its effectiveness in managing neuropathic pain and its ability to be combined with other pain management methods. Since gabapentin and similar drugs are particularly effective at treating nerve pain, which often feels like burning, shooting, or tingling, they are an important part of multimodal analgesia, using multiple drugs or techniques to manage pain from different angles. This approach leads to better pain control and can reduce the need for higher doses of opioids, which carry risks of side effects and addiction.

What Made Companion Animals the Dominant Segment in the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in 2024?

The companion animals segment dominated the market in 2024, driven by increased pet ownership and a willingness of pet owners to spend on advanced treatments, including NSAIDs for pain management. The rise in global pet ownership has expanded the pool of animals requiring NSAIDs for pain and inflammation. Pet owners are increasingly treating their animals as family members, motivating them to pursue advanced therapies. With the increased humanization of pets, pet owners have become more conscious of their pets' health. Additionally, the availability of advanced veterinary facilities and treatments, such as monoclonal antibodies, regenerative medicine, and laser therapy, further supports this growth.

The livestock animals/farmers segment is expected to experience rapid growth in the upcoming period, primarily due to the rising global demand for animal protein and the need to maintain the health and productivity of food-producing animals. As the world’s population grows and demand for meat, milk, and eggs increases, the demand for NSAIDs also increases among livestock farmers. Using NSAIDs helps ensure the health and productivity of livestock by managing pain and inflammation related to various conditions and procedures. NSAIDs are used to manage pain and inflammation in livestock, which can improve their overall welfare, particularly during common procedures such as castration, dehorning, and tail docking. Advancements in veterinary care and the need for effective disease management in livestock are also driving the growth of this segment.

How Does the Oral Segment Dominate the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in 2024?

The oral segment sustained dominance in the market in 2024. This is mainly due to the increased adoption of tablets and chewables, driven by their ease of administration and the availability of a wide range of approved oral drugs. Oral administration is generally the most convenient and least stressful method for both pet owners and animals. These medications are often more cost-effective than injectables or other formulations, making them a practical choice for long-term treatments. A broad spectrum of NSAIDs is available in oral forms for various animal species, including dogs, cats, and horses, making it a versatile option for different needs. Additionally, many pet owners find oral medication easier to give than injections or topical applications, which may require veterinary assistance or cause discomfort to the animal.

The injectable segment is expected to grow at the fastest rate over the projection period. The segment growth is primarily attributed to the increasing demand for rapid and effective pain relief, especially in post-operative and acute pain management scenarios. Injectable NSAIDs offer quicker pain relief compared to oral formulations, making them ideal for immediate pain management after surgery or injury. Injectable administration bypasses the digestive system, resulting in better drug absorption and higher concentrations in the bloodstream, thereby ensuring more effective pain control. The rising number of surgeries in companion animals, such as spaying, neutering, and orthopedic procedures, along with increased awareness of pain management in livestock, contribute to the growth of injectable NSAIDs. In addition, the rising demand for targeted drug delivery supports segmental growth.

Why Did the Musculoskeletal Disorders Segment Dominate the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in 2024?

The musculoskeletal disorders segment dominated the market, with osteoarthritis holding the largest share in 2024. This is primarily due to the increased prevalence of these conditions in animals, particularly dogs, horses, and older animals, which boosts the demand for NSAIDs in managing pain and inflammation associated with these conditions. NSAIDs are effective in reducing pain and inflammation caused by these conditions and are thus a cornerstone of treatment. The development of COX-2 selective inhibitors like firocoxib and mavacoxib has improved pain management by reducing the risk of gastrointestinal side effects compared to older, less selective NSAIDs.

The post-operative pain segment is expected to grow rapidly in the market. The growth of the segment is primarily attributed to the rise in surgical procedures, advancements in pain management techniques, and a growing emphasis on pain control for improved patient outcomes. As veterinary medicine advances, more complex surgeries are performed on pets, increasing the demand for effective post-operative pain management. Veterinarians are increasingly adopting multimodal analgesia approaches, combining different medications and techniques to achieve comprehensive pain relief. Additionally, continuous research and development in NSAIDs are enhancing their efficacy and safety profiles, making them more attractive for post-operative pain management.

How Does the Veterinary Clinics & Hospitals Segment Lead the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in 2024?

The veterinary clinics & hospitals segment dominated the market in 2024. This is primarily due to the high volume of patient visits, increased demand for specialized treatments, and veterinarians' preference for in-house dispensing. Since veterinary clinics and hospitals handle a wide range of cases, including routine check-ups, surgeries, and specialized treatments, there is a higher demand for NSAIDs to manage pain and inflammation. These facilities offer advanced diagnostic and treatment options, including specialized pain management therapies, where NSAIDs play a vital role. The segment’s dominance is reinforced by the availability of comprehensive healthcare services and the convenience they offer to pet owners.

The online pharmacies segment is expected to experience rapid growth in the coming years. This is primarily due to the increased accessibility, convenience, and competitive pricing offered by these pharmacies. The rise of e-commerce platforms is increasing the accessibility to pet care products, including NSAIDs. Pet owners can easily order medications from the comfort of their homes, saving time and effort compared to visiting physical stores. They often provide discounts and competitive pricing, making medications more affordable. As consumers seek convenient and cost-effective ways to manage their pet health, the growth of the segment is set to rise.

What Made the Pet Owners Segment Dominant in the Veterinary Analgesics/Anti-Inflammatory (NSAIDS) Market in 2024?

The pet owners segment led the market in 2024. This growth is driven by increased pet ownership, rising awareness of animal health, and the humanization of pets. Pet owners are increasingly seeking effective pain management options for their animals, particularly as pets age and require specialized care. Veterinarians play a crucial role in educating pet owners about pain management, further boosting demand for NSAIDs. Growing awareness about animal welfare and ethical treatment of pets encourages owners to seek the best possible care, including pain relief. This trend is also supported by government regulations and guidelines that promote animal welfare. Advances in veterinary medicine and drug formulations, along with growing concerns about animal welfare, continue to fuel this trend.

The livestock owners’ segment, especially for large-animal surgeries, is the fastest-growing part of the market. This growth is primarily driven by increased livestock production, heightened awareness of animal welfare and pain management, and the growing use of NSAIDs in livestock health and production practices. Globally, there is a growing demand for meat and dairy products, resulting in increased livestock farming and a greater need for effective pain management during surgeries and procedures. The availability and accessibility of veterinary services for large animals are improving, prompting more livestock owners to seek veterinary care, including surgeries that require NSAIDs for pain relief.

By Drug Class

By Animal Type

By Route of Administration

By Indication

By Distribution Channel

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Deepa Pandey, one of our esteemed authors, plays a crucial role in shaping the high-quality content that defines our research reports. Deepa holds a Master's in Pharmacy with a specialization in Pharmaceutical Quality Assurance, equipping her with an in-depth understanding of the healthcare industry's regulatory, quality, and operational nuances. With 2+ years of experience in market research, Deepa has made

Learn more about Deepa PandeyWith over 14 years of experience, Aditi is the powerhouse responsible for reviewing every piece of data and content that passes through our research pipeline. She is not just an expert—she’s the linchpin that ensures the accuracy, relevance, and clarity of the insights we deliver. Aditi’s broad expertise spans multiple sectors, with a keen focus on ICT, automotive, and various other cross-domain industries.

Learn more about Aditi Shivarkar